Deregulation is bad for any nation.

Is it the responsibility of the people we have elected to represent

and safeguard the interests of the public at large? Should the banks and corporations do as they

please under the free market? Have we not learned bad lessons of deregulation?

Now the Libor crisis, i.e., fixing the indexed rates (Libor) on interest among

the bank themselves is leading to the bank failures.

and safeguard the interests of the public at large? Should the banks and corporations do as they

please under the free market? Have we not learned bad lessons of deregulation?

Now the Libor crisis, i.e., fixing the indexed rates (Libor) on interest among

the bank themselves is leading to the bank failures.

The deciders can go to bloody hell, but should the public bear

the brunt of it? After all it is public

funds, and public trust in the banks. Should

the executives be thrown in Jail for the disaster or should they be given

bonuses while the public at large loses?

the brunt of it? After all it is public

funds, and public trust in the banks. Should

the executives be thrown in Jail for the disaster or should they be given

bonuses while the public at large loses?

I am a Republican, and I implore fellow Republicans to

advocate sensible responsible polices, not to hinder business, but not to let

business abuse the freedom. Work with the Democrats for un-deregulating the

banking industry.

advocate sensible responsible polices, not to hinder business, but not to let

business abuse the freedom. Work with the Democrats for un-deregulating the

banking industry.

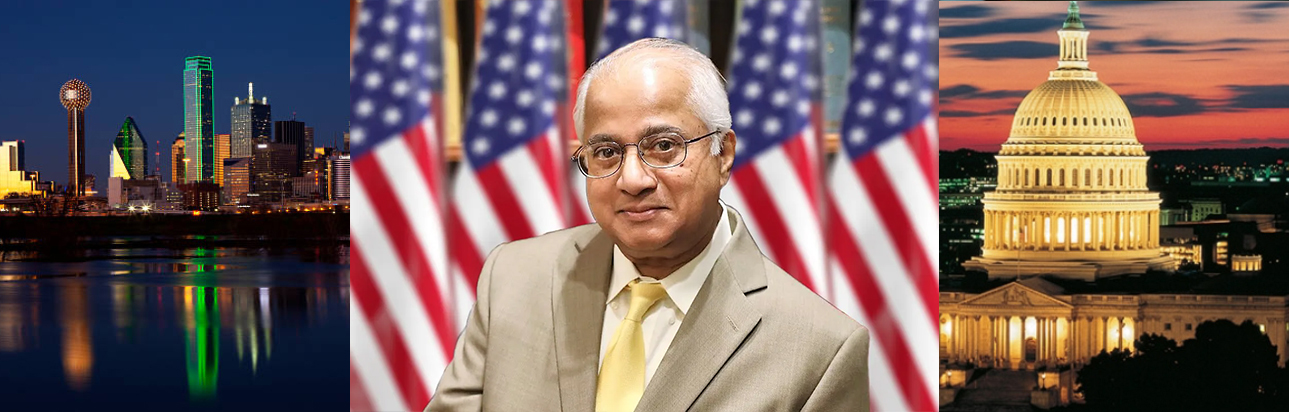

MikeGhouse is committed to building a Cohesive America and offers pluralistic solutions on issues of the day. He is a professional speaker, thinker and a writer on pluralism, politics, civic affairs, Islam, India, Israel, peace and justice. Mike is a frequent guest on Sean Hannity show on Fox TV, and a commentator on national radio networks, he contributes weekly to the Texas Faith Column at Dallas Morning News and regularly at Huffington post, and several other periodicals across the world. The blog www.TheGhousediary.comis updated daily.